De-risking offshore wind energy

Europe has seen exponential growth in offshore wind energy over the last decade with the UK at the forefront. New licences recently awarded by the UK government, for example, will see offshore generating capacity increase from about 2 GW to around 33 GW by 2020 [Ref. 1], which is equivalent to the output of about 30 modern nuclear reactors.

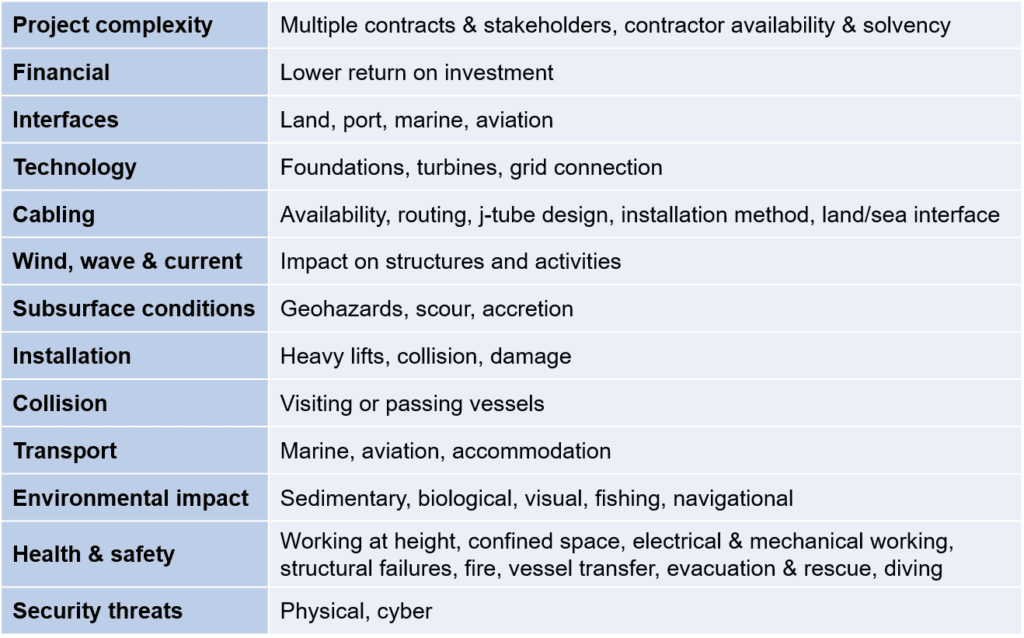

WHAT ARE THE RISKS?

Box 1 identifies the most significant risks associated with developing and operating offshore wind farms. These encompass, for example, the fact that:

- Cabling incidents have historically been the number one source of insurance claims.

- No offshore wind farm construction project has been completed without contractor going bankrupt.

- Large 5 MW turbines need to be designed, manufactured and then proven in field-operating conditions for a period of 2-years.

- Tailor-made vessels for transporting the turbines will typically take 4 years to design and construct.

- During the operational phase the hazards of ‘blade throw’ and gross structural failure are ever present, (depicted above).

Furthermore, the return on investment is highly sensitive to cost and time over-runs. A typically expected return on investment of 10% per annum would be reduced to 9% should the project over-run by 12 months, which is generally considered a 50:50 chance, or to 8.5% in the event of a 10% cost over-run [Ref. 2].

While the ultimate consequences of incidents affecting people are generally less severe than risks from offshore oil & gas platforms, they could still result in fatalities, delays, increased costs and loss of reputation. As a result, the UK’s health & safety watchdog, the HSE, has categorized offshore wind as a “high” rather than “major” hazard industry [Ref.2].

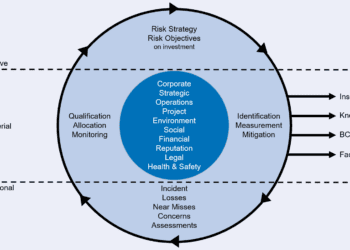

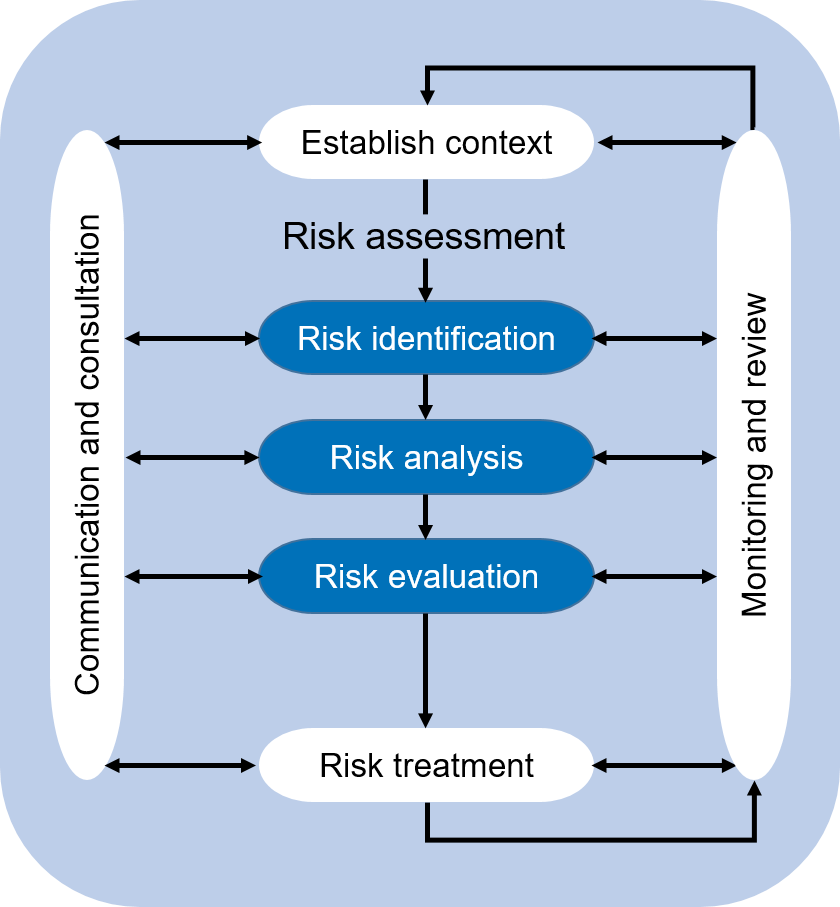

HOW SHOULD THESE RISKS BE MANAGED?

The approach required to manage offshore wind development risks effectively can draw on the experience of processes, tools and techniques proven and optimised over many years in the oil & gas, transport and nuclear sectors (see Fig. 1). These are readily transferable, but come with a number of challenges, including:

- Ensuring that the overall approach and level of detail is proportionate to the risk.

- Finding the appropriate balance between qualitative and quantitative risk assessment techniques.

- Identifying risks as early as possible, recognising that the cost of risk controls escalate significantly as the project progresses while their effectiveness diminishes

- Ensuring visibility and effective “hand-over” of risks across life-cycle interfaces, particularly when owned by different stakeholders.

- Seeking “lessons learned” from previous experience and similar developments.

- Taking positive steps to gather meaningful industry-specific operating and failure data to improve understanding of the risks.

- Remembering that applying the right processes, tools and techniques alone will not reduce risk – implementation of tangible risk reduction measures is needed.

MISTAKEN IDENTITY?

An offshore wind farm could be viewed as either an onshore wind farm that happens to be offshore or a marine construction that happens to include wind turbines. Whilst this is understandable given the industry’s relative infancy and the rapid influx of interested parties from a wide range of backgrounds, neither perspective provides a complete picture of the associated risks and also brings competing approaches to risk management which are far from unified.

The time is surely ripe for the offshore wind industry to embrace its own identity and channel its collective knowledge and experience into tackling the specific risks and other challenges of offshore wind generation.

This article first appeared in RISKworld Issue 19