Know your breaking point: the benefits of organisational stress testing

INTRODUCTION

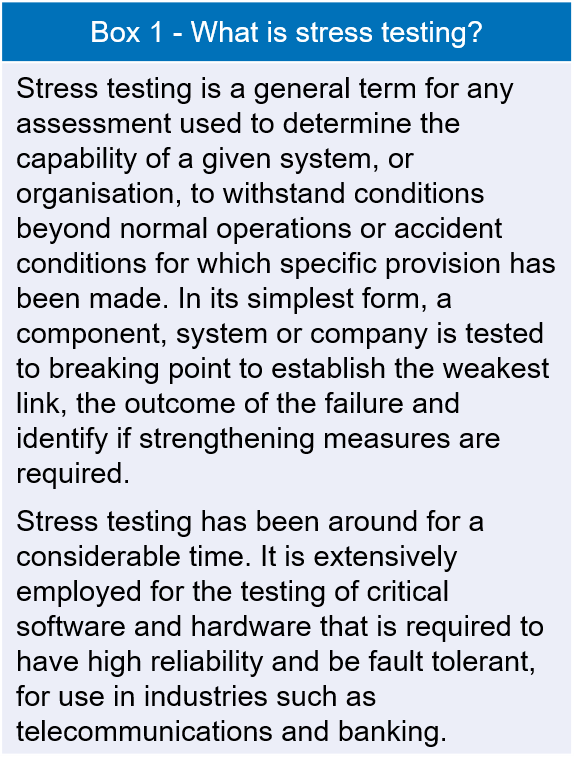

The term ‘Stress Testing’ has featured in the headlines over the past few years as authorities respond to the worldwide banking crisis and, more recently, the Fukushima nuclear power plant incident. Banks or operators of nuclear facilities have been required, or encouraged, to undertake ‘Stress Tests’ to assess the ability of their organisation to withstand extreme conditions. In both cases, stress testing was reactive, in that it was initiated after crises had occurred, and was intended to assess the resilience of similar organisations (see Box 1).

Naturally, the financial sector’s stress tests focus on business resilience, whilst the nuclear industry’s focus is very much on the safety of people.

COMMON CHARACTERISTICS

Although quite different in focus, stress tests in the financial and nuclear sectors have some common characteristics:

- They are implemented after an actual event has brought an issue into public scrutiny and attracted the attention of politicians and regulators.

- They are initiated by an actual event, but are not intended to be restricted to this event.

- To be effective they require organisations to be open minded when conducting the assessment.

- They assess the ability of an organisation to respond to, and manage a major incident.

- They improve understanding, but don’t reduce risk until changes (physical or procedural) are successfully implemented

AVOIDING STRESS

High profile incidents invariably lead many boards of companies operating in hazardous sectors to consider the exposure of their organisation. Indeed, some companies have started initiatives to assess critically their organisation’s exposure and resilience to “Major Accident Events”. This goes beyond regulatory requirements (which concentrate mainly on safety and environmental risk) and examines the potential financial and reputational impact. A variety of approaches can be adopted, depending on the nature and scale of the organisation, but will typically comprise desktop reviews, workshops, qualitative and/or quantitative assessment and facility based audits.

Low frequency, high impact events should be identified and assessed in all highly regulated industries. Indeed some regulators require the potential for ‘cliff edges’ (a small change that leads to a disproportionate increase in risk) to be examined. However, in practice, these rare events can be difficult to deal with and demonstrate convincingly that risks are tolerable and ALARP.

Major incidents are regrettable, and no doubt with the benefit of hindsight, are avoidable. However, it is important that the lessons learned from major incidents are well understood, shared across industries and changes implemented in an effort to prevent re-occurrences.

CONCLUSION

Proactive organisations are starting to utilise a stress test approach to assess their operations “beyond regulation”, while considering the potential wider impact on their business. This helps improve the understanding of the organisation’s resilience, and informs the identification of practical risk reduction measures, while demonstrating a commitment to safe and sustainable operations.

This article first appeared in RISKworld Issue 21