Nuclear powered UK – from requirement to reality

Nearly two years on from the publication of the UK government’s energy review in July 2006, the prospect of new nuclear power stations in the UK is edging closer to reality. May 2007 saw the “Meeting the Energy Challenge” White Paper state that the government was “proceeding, on a contingent basis”. The January 2008 Nuclear Energy White Paper confirmed that it would be in the public’s interest to allow private sector companies the option of investing in new nuclear power stations.

These announcements have led to a significant increase in activities in the UK involving reactor designers, operators, utilities, investors, contractors and manufacturers from around the world, all interested in playing a part in this long awaited nuclear renaissance.

In response to the 2006 Energy Review, four potential reactor vendors sought support from potential nuclear operators and in the Spring of 2007 applied for their design to be considered in the opening phases of the UK regulators’ “generic design assessment” of new nuclear reactors, i.e. the generic pre-licensing of their designs.

The four reactor designs are:

- AECL’s Advanced Candu Reactor – ACR 1000

- Areva’s Evolutionary Pressurised Water Reactor – EPR

- GE-Hitachi’s Boiling Water Reactor – ESBWR

- Westinghouse’s Advanced Pressurised Water Reactor – AP 1000

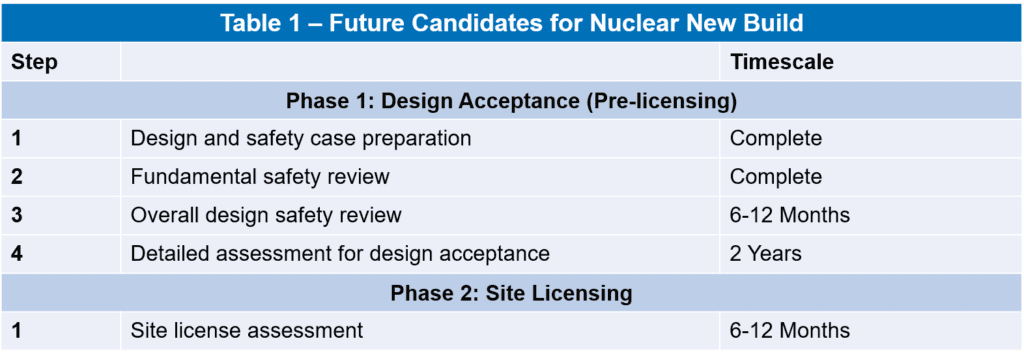

By September 2007, all four designers had made their Phase 1 Step 2 pre-licensing submission to the UK Regulators [see Table 1] with the aim of demonstrating that, in principle, their generic designs were capable of being licensed in the UK.

This phased and progressive generic prelicensing process aims to reduce regulatory and planning risks and introduces a number of innovative ideas in the UK regulatory framework including:

- An integrated Security, Safety and Environmental Regulatory process managed via a Joint Programme Office comprising:

- OCNS (Office of Civil Nuclear Security)

- NII (Nuclear Installations Inspectorate)

- EA (Environment Agency).

- The initial use of a generic site envelope rather than a specific site.

- An expectation that designs and safety cases would be largely ‘off the shelf’ but still demonstrate UK-specific regulatory requirements.

- Consideration of assessments carried out by foreign regulators.

- Openness and public involvement.

The public involvement process required vendors to publish their pre-licensing submissions and encourage public review and comment of their design submission. This has required a difficult balance between openness on one hand and the need to safeguard commercially sensitive information and national security.

The regulators have recently completed their Step 2 assessment of each of the four designs, informed by the public involvement process. Overall, they conclude that there is no fundamental reason why each of the designs should not proceed to Step 3. This milestone marks the start of the government’s prioritisation process which is expected to identify the three designs that are most likely to be built in the UK. Until this decision is made vendors are proceeding with their second submission at their own risk.

A great deal of parallel activity has also been ongoing with potential investors, utilities and operators exploring partnerships with designers, builders, manufacturers and their supply chain to understand the technologies on offer as they relate to constructability, operability, maintainability and return on investment. Such is the interest in new build that there were over 80 participants, representing over 15 organisations from 7 countries at a recent seminar for potential operators run by the UK regulators.

FUTURE TIMESCALES

Current timescales are driven by the government requirement that new nuclear power stations should be licensed and operational in the UK within the 2016- 2022 timeframe. The view in industry is that the first plant could be operational by 2017 – however, this will require site specific work to commence in 2009, a planning application in 2010 and a start on construction in 2013.

CHALLENGES AHEAD

The ability to meet these timescales is itself a challenge, noting that all four potential vendors and many of the potential operators are new to the UK regulatory environment. However, despite the increasing acceptance of nuclear power as part of the future energy mix, there are a number of issues that remain a threat to making nuclear power a reality in the UK, such as:

- Nuclear safety and security

- Waste management and disposal

- Construction cost and time over-runs

- Limited international manufacturing capacity

While navigation through these and other issues may not be easy, the nuclear industry and UK government can take confidence in coming this far in less than 2 years.

This article first appeared in RISKworld Issue 13.