CCS Liability Analysis – Calculating the insurance risk of CO2 leakage from carbon capture and storage

Once carbon is safely stored, we have a responsibility to keep it in place. Aside from the environmental impacts of any leaks, there can also be financial impacts on operators, which may be hedged by insurance. In this article we take a look at how standard safety risk assessment techniques can be used to quantify the financial risk associated with CO2 leaks from Carbon Capture and Storage (CCS) projects.

DRIVERS FOR QUANTITATIVE ANALYSIS

With all endeavours, but particularly for novel technologies or new applications, comes the need for assurance that risks are acceptable. For CCS projects, operators, regulators and government have an interest in quantifying the likelihood and magnitude of CO2 releases to confirm that risk targets can and will be met. In the longer term, the government may also eventually assume the leakage liability for the storage site post-closure.

From the outset, operators have a clear financial incentive to minimise CO2 leak risks, as they are effectively being paid to store the CO2 securely. They may choose to transfer some or all of the financial liability associated with leaks through insurance, but this comes at a price – the insurance premium – which must be calculated and accepted by the insurers and underwriters based on quantitative analysis of leakage risks.

Whilst structured qualitative methods, such as bowties, allow for a clear understanding of the controls in place to manage CO2 containment risk, additional techniques are required to provide quantitative risk estimates.

OPERATIONAL EXPERIENCE AND DATA ARE SCARCE

For standard, known operations (e.g. pipeline transportation) there are accepted methods of quantifying safety and financial risk which have been developed over many years. Any risk estimate outputs are underpinned by registers of historical data. For the nascent CO2 storage industry, there is limited operational experience at only a handful of storage projects. In particular, subsurface leaks from a storage site are tricky to assess, given the difficulties in characterising and predicting the behaviour of geological structures several kilometres below the surface, compounded by the inherent uncertainty [Ref. 1].

RISK ANALYSIS

Calculating the CO2 leakage risk involves identifying critical leakage scenarios, and then estimating:

- The likelihood of occurrence

- The mass of CO2 released

- The associated costs

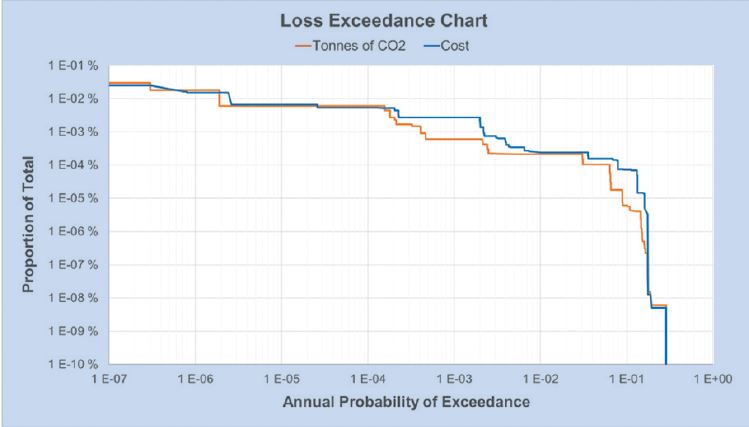

Typically, the outputs required will come in the form of:

- A list of credible leakage events

- The annual probability weighted mass/cost of leaks

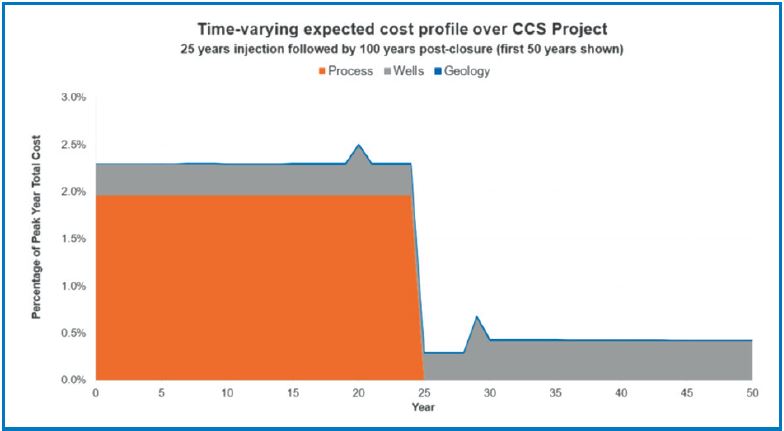

- A loss exceedance curve (e.g. Figure 1)

- A time-varying expected cost profile throughout the project (e.g. Figure 2).

Scenarios may be identified via structured techniques such as HAZID, by reference to established sources such as the Features, Effects and Processes (FEP) database, or by reference to research studies, especially where geological leak paths are concerned.

SCENARIO ANALYSIS

Process Quantitative Risk Assessments (QRAs) for the capture and transport portions of CCS projects make use of established methods of leak quantification – such as parts count with frequency analysis – and provide estimates of both the frequencies and severities of leaks. Non-process risks, such as those relating to ship collisions and dropped objects, are also straightforward to evaluate using standards methods and data.

Leaks from the storage site, either via geological pathways or via wells, are less readily quantifiable, however a number of studies have developed data for release scenarios from storage sites in the North Sea (such as Refs. 2 to 4). For each release scenario, the studies provide generic estimates of likelihood of occurrence (e.g. per year, or per project over its lifetime), the mass of CO2 released (e.g. tonnes/day) and the duration (e.g. allowing for well interventions to halt leaks or self-healing of fractures within a primary seal).

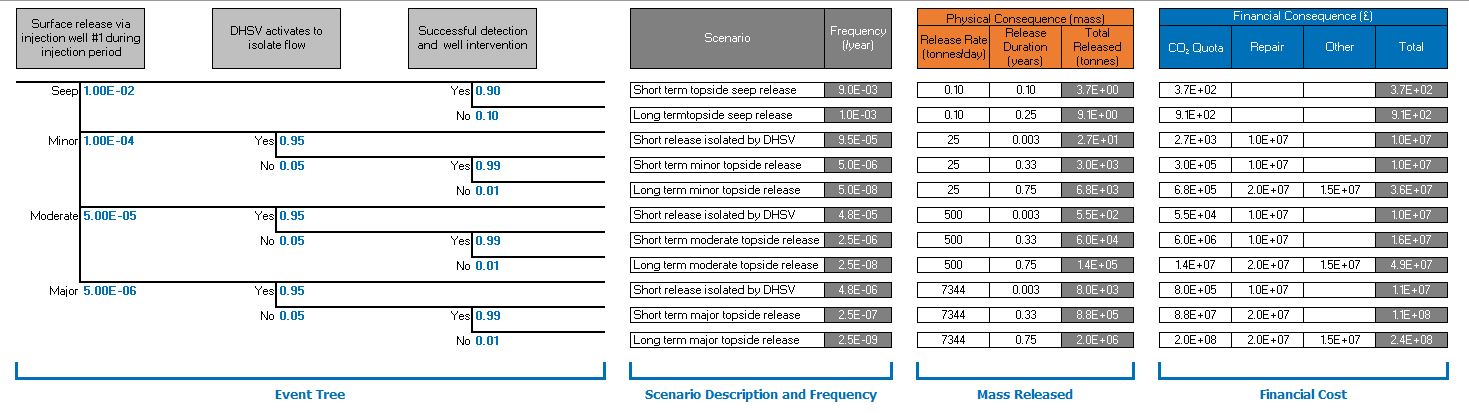

Unless or until site-specific data become available (e.g. using the methods proposed in ongoing research, such as Ref. 5), the challenge is to make generic data site-specific, and then to extrapolate the financial impact. As a first approximation, developing a simple event tree for each scenario is very useful for both aspects, with an example event tree shown in Figure 3. An expanded version of Figure 3 is shown in Ref. 6.

GROWING THE TREE

The event tree’s initiating event frequency allows for site-specific and time-dependent estimates to be included, such as:

- The number of legacy wells.

- The frequency of planned well interventions each year, or

- The varying likelihood of primary seal leakage as pressure within the store changes throughout the injection period and post-closure.

The nodes of the event tree also allow site-specific features to be added (e.g. the presence of secondary seals, the proximity of legacy wells).

Each accident sequence (route through the event tree) generates a data point of likelihood and total mass of CO2 released. To each of these we can add sequence-specific cost estimates, such as for repairs/replacements, increased monitoring following a release, well intervention/remediation, and the ‘lost’ cost for each tonne of CO2 released.

OUTPUT

All event tree outcomes can be enumerated on a yearly basis for the period of interest, enabling yearly exceedance curves to be calculated (e.g. as shown in Figure 1). By multiplying the frequency by the mass/cost, an expected mass/cost per year can also be calculated, and then summed over the lifetime of the project to give a cumulative quantitative risk.

Given the amount of expert judgement and inherent uncertainty involved in the analysis, sensitivity studies are advisable. It is also possible to compare results to the equivalent for conventional operations (e.g. hydrocarbon safety risk liabilities), and the published values for a typical CCS project – for instance, the Zero Emissions Platform (ZEP) calculated the annual expected cost for a project to be around €850k [Ref. 3].

CONCLUSION

It is possible to repurpose standard quantitative and semi-quantitative safety risk analysis methods, coupled with data from relevant literature, to estimate site-specific CO2 leakage rates and calculate insurance liabilities covering the entire CO2 value chain of a CCS project, from capture through to storage.

Although operational experience is scarce, there are some useful sources of data, but expert judgement needs to be applied to produce meaningful analysis results.

This article first appeared in RISKworld 43, issued May 2023.

References

1. Risktec. Uncertain Times – Dealing with uncertainty in quantitative risk assessment: A CCS case study, RISKworld Issue 41, Spring 2022

2. Open Government Licence (OGL). Deep Geological Storage of CO2 on the UK Continental Shelf: Containment Certainty, February 2023. Available at

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1134212/ukcs-co2-containment-certainty-report.pdf

3. Zero Emissions Platform (ZEP). CO2 Storage Safety in the North Sea: Implications of the CO2 Storage Directive, November 2019

4. AGR/SCCSS. CO2 Storage Liabilities in the North Sea – An Assessment of Risks and Financial Consequences, May 2012

5. Skurtveit et al, Improved quantification of CO2 storage containment risks – an overview of the SHARP Storage project, Proceedings of the 16th Greenhouse Gas Control

Technologies Conference 23-24 Oct 2022, Available at SSRN: https://ssrn.com/abstract=4284893

6. Risktec. CCS Liability Analysis – Calculating the insurance risk of CO2 leakage from carbon capture and storage, RISKworld Issue 43, Spring 2023. https://risktec.tuv.com/

risktec-knowledge-bank/qualitative-deterministic-risk-assessment/ccs-liability-analysis-calculating-the-insurance-risk-of-co2-leakage-from-carbon-capture-and-storage/