An introduction to modern asset integrity management

The recent Deepwater Horizon incident in the Gulf of Mexico reinforces the fact that every operator of high-hazard physical assets is exposed to low-frequency high-impact risks. Every operator has a corporate goal of preventing major incidents by managing the governance and integrity of its assets. A robust corporate asset management framework, within which an integrity management regime can operate, is one way of achieving this aim.

GOOD PRACTICE IN ASSET MANAGEMENT

Increasing international consensus on good practices for managing physical assets led to the publication of PAS 55:2008 [Ref. 1], a specification based on the familiar BS ISO format used in such widely adopted standards as ISO 14001 for environmental management and OHSAS 18001 for safety management. Fifty participating organisations (in 15 industries and 10 countries) were involved. A number of global energy and transport organisations have already been certified as complying with the standard and interest in the industrial community is growing rapidly.

Asset management is defined in the standard as:

Systematic and coordinated activities and practices through which an organisation optimally and sustainably manages its assets and asset systems, their associated performance, risks and expenditures over their life cycle for the purpose of achieving its organisational strategic plan.

Put more simply, it is the optimal management of assets over their whole life cycle. PAS 55 primarily focuses on managing physical assets, though the other broad categories of ‘assets’ such as human assets, information assets, financial assets and intangible assets (reputation, etc.) are considered where they have a direct impact on the effective management of physical assets.

REQUIREMENTS

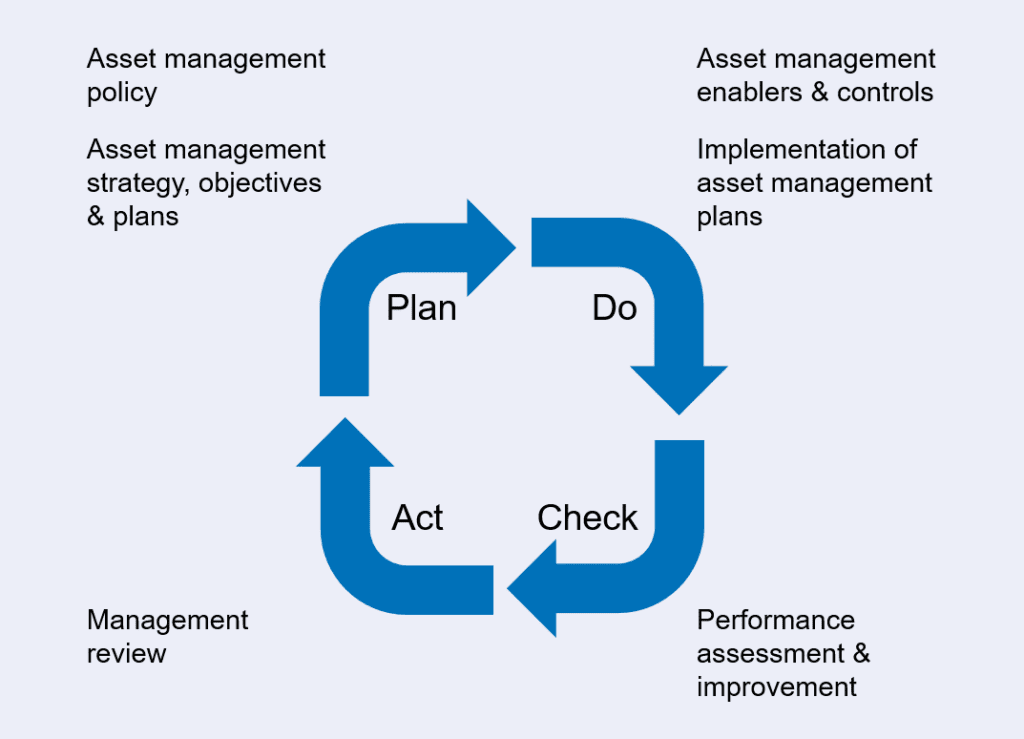

PAS 55 defines 28 explicit requirements, arranged under 6 main groups within the quality management Plan-Do-Check-Act (PDCA) framework [see figure].

IT’S NOT EASY

Delivering the best value for money in the management of assets and their integrity is complex and involves careful consideration of the inevitable trade-offs between short-term and long-term benefits, or between performance, cost and risk across all stages of the assets’ life cycle. This often requires a fundamental review of stakeholder expectations, as well as a consistent and scalable method for determining the criticality and value of assets and activities. Having a modern asset management system to manage asset integrity is clearly essential if an organisation is to optimise the diversity and complexity of such trade-offs in line with its corporate objectives, priorities and chosen risk profile.

THE RISK MANAGEMENT ‘ENABLER’

A key requirement is the risk management ‘enabler’. There is a need to establish and implement robust risk management processes and identify and assess credible risks, whether due to physical failures, natural environmental events, the supply chain, or stakeholder dependencies. Most important is the need to ensure the results of these processes are used to inform the asset management strategy, identify adequate resources and competency needs, and determine the controls for the asset’s life cycle. The toolbox of techniques to help achieve this includes:

- Safety & risk management (HAZID, HAZOP and QRA)

- Safety integrity level (SIL) studies

- Process system integrity studies

- Risk-based inspection

- Condition monitoring studies

- Reliability-centred maintenance

- Damage identification & risk assessment

A guide on asset integrity published by the International Association of Oil & Gas Producers provides detailed good practice on the asset integrity risk management process [Ref. 2].

BENEFITS

Typical benefits quoted from the successful implementation of modern disciplined approaches to asset management [Ref. 3] include:

- 17% increased output at 50% lower operating cost (Shell North Sea oil platforms)

- 28% reduction in planned system downtime (National Grid)

- 29% increased output at no extra cost (Baltimore power generation)

As well as optimising the return on investment in assets, other benefits include demonstrating compliance with regulation, improving proactive risk management and governance, and sustainability commitment.

SUCCESSFUL IMPLEMENTATION

Simply having a set of processes and procedures for asset management is one thing, successfully implementing them is quite another. Overcoming a ‘silo’ mentality between different departments is a common hurdle. Other critical factors for successful implementation include:

- Senior management buy-in and support

- Understanding and managing all asset related risks

- Defining, collecting and using the correct information to inform decisions

- Regular reviews and challenging of asset management related activities

CONCLUSION

Asset integrity management isn’t about squeezing as much life out of assets as possible; it is about ensuring consistent performance of assets, throughout their lives, to deliver the business objectives profitably and without major incident. PAS 55 provides a good practice asset management framework for robust integrity management. The resulting performance, cost, safety and reputational benefits would appear to be well worth the sustained effort.

References

1. Asset Management, PAS 55:2008, BSi, September 2008.

2. Asset Integrity – The Key to Managing Major Incident Risks, OGP, December 2008.

3. What is Asset Management in 2010?, The Institute of Asset Management, 2009.

This article first appeared in RISKworld Issue 18