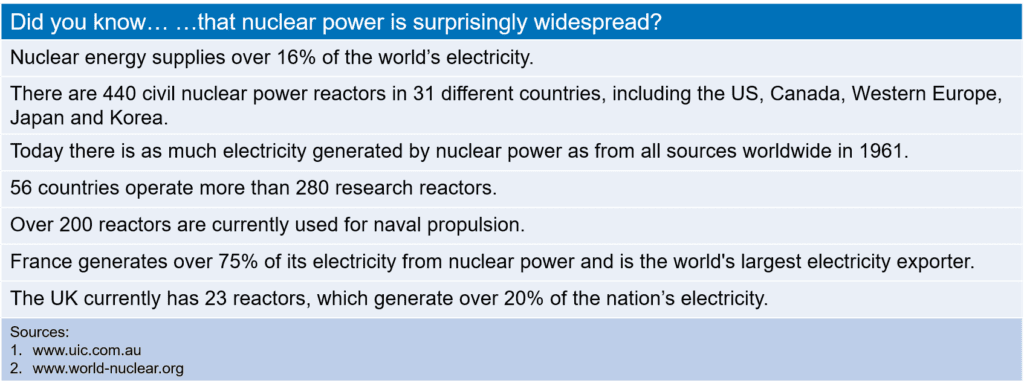

Nuclear power – if there’s a will there’s a way

The publication of the UK government’s energy review in July 2006 [Ref. 1] signalled the re-emergence of nuclear power as a politically viable means of providing a balanced proportion of the country’s future energy needs. The energy review concludes that “higher projected fossil fuel prices and the introduction of a carbon price to place a value on CO2 have improved the economics of nuclear as a source of low carbon generation” and that “new nuclear power stations would make a significant contribution to meeting our energy policy goals”.

With the necessary political will seemingly in place, the challenges for the nuclear industry can be brought into sharper focus. These are interlinked and include:

- Financing of new build projects

- Choice of reactor design

- Waste disposal

- Streamlining regulatory and planning consent

FINANCING OF NEW BUILD PROJECTS

In its energy review, the UK government makes it clear that it expects the private sector to “initiate, fund, construct and operate new nuclear plants and to cover the full cost of decommissioning and their full share of long-term waste management costs”. This demanding expectation is tempered with promises to address potential investment barriers to new nuclear build, including:

- Introducing the concept of pre-licensing by the Nuclear Installations Inspectorate

- Decoupling regulatory assessment from the land-use planning application

- Providing a decision on the long-term management of radioactive waste

Even with these measures in place, there is speculation that the government will need to provide incentives to attract investors. The short-term and volatile nature of the electricity market in the UK makes longterm investment presently unappealing.

This situation is compounded by the state of the carbon market, which was introduced by the EU Emissions Trading Scheme in January 2005. Although carbon trading should, in principle, allow energy businesses to profit from low CO2 emissions, in practice the price of carbon has fluctuated too wildly to back investment decisions. Until the carbon market stabilises, capital outlay in new nuclear power stations may not be tenable unless businesses can secure some form of guaranteed premium (as is currently the case for renewable generation) or a long-term price assurance from the government.

Figure 1 – Framatome EPR

Figure 2 – Westinghouse AP1000

REACTOR DESIGN

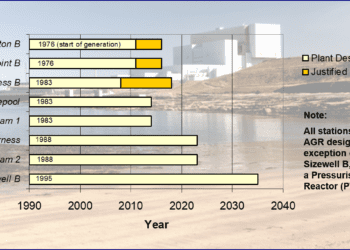

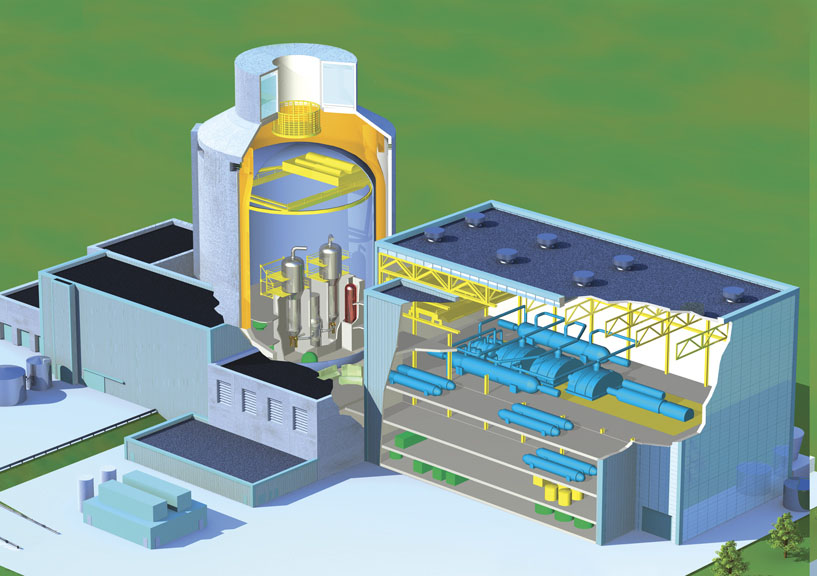

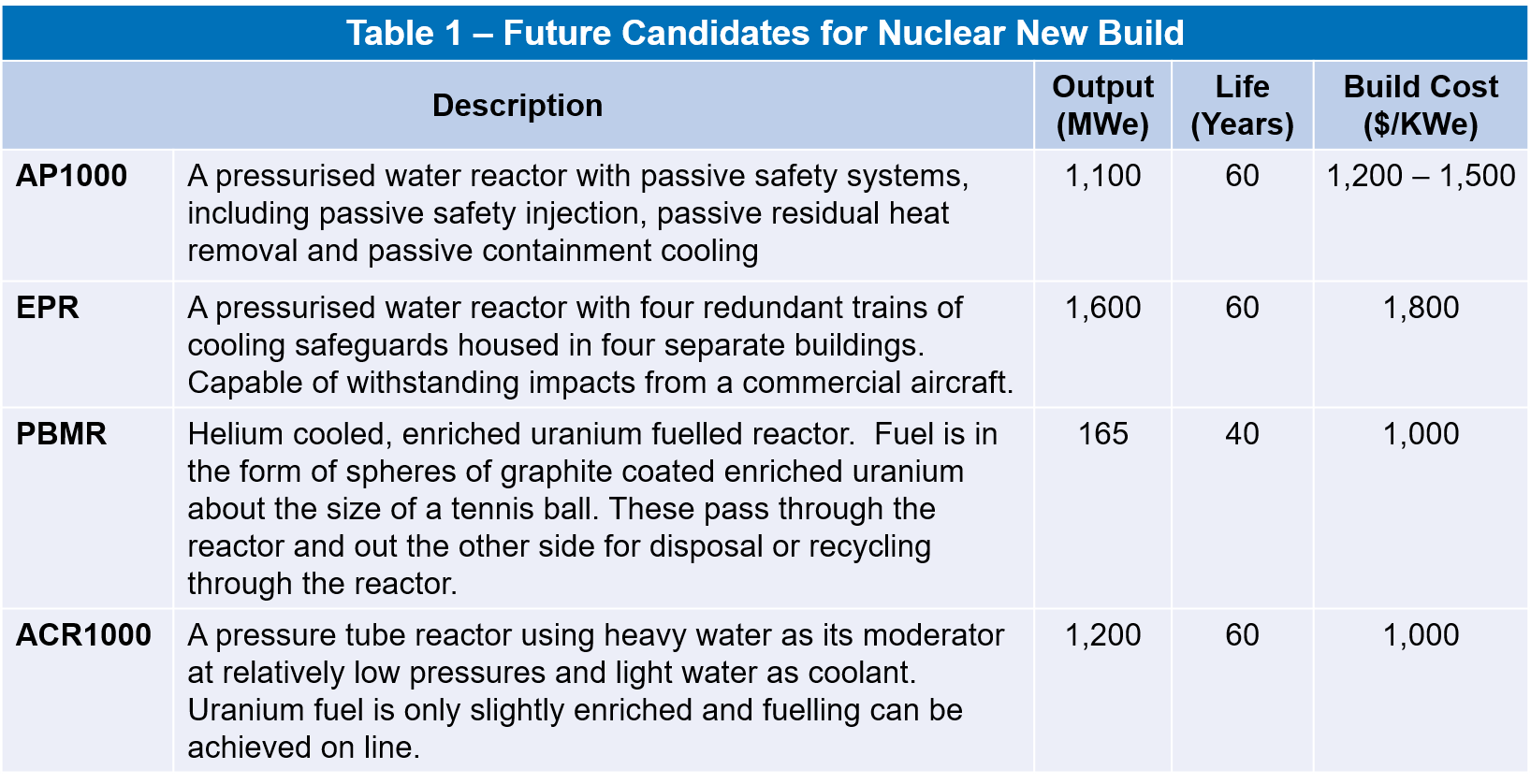

The front runners for new build appear to be the Framatome ANP European Pressurised water Reactor (EPR) and the Westinghouse AP1000 (see Figures 1 & 2 and Table 1). These Generation III+ Pressurised Water Reactors (PWRs) claim to offer improved safety, reduced construction and operating costs, reduced build times and increased operating lifetimes.

An EPR is under construction in Finland having been granted permission to proceed by Finnish regulators, while the AP1000 has been given ‘Design Certification’ by US regulators for certain applications, but has not yet been built. These types of reactors are similar in principle to the UK’s Sizewell ‘B’ PWR.

Outsiders include the Canadian Advanced CANDU Reactor (ACR), which is a pressure tube reactor, and the Pebble Bed Modular Reactor (PBMR), which is due to start construction in South Africa in 2007 [see Table 1].

WASTE DISPOSAL

The UK’s position on nuclear waste is outlined in the energy review [Ref 1]. For intermediate and high level waste the Committee on Radioactive Waste Management (CoRWM) has proposed that deep geological disposal in a repository is the best option, with a programme of interim storage until this facility can be made available.

For Low Level Waste the use of purpose built surface level facilities appears to be the current preference. For the moment, there appears to be no strategic plan to replace the reprocessing facilities at Sellafield, presumably because of the high dependency on the choice of new reactor design. The government has, however, accepted overall responsibility for managing waste, but expects the costs to be borne by the nuclear power generation industry.

REGULATORY & PLANNING CONSENT

To build a new nuclear power station in the UK consent is required from the government, to ensure that it fits in with overall energy policy. A licence is needed from the Nuclear Installations Inspectorate, which deals with safety, and the operator needs to be authorised by the environmental regulator to release small quantities of radioactivity in routine discharges. Additionally, planning permission for a particular site is required to assure compatibility with local intentions for the use of land, which can lead to a public enquiry covering all aspects of consent.

As part of the energy review, the government is airing proposals to streamline the planning consent process. Strategic and regulatory issues would be dealt with outside the public enquiry process, which would be constrained to examining local planning issues.

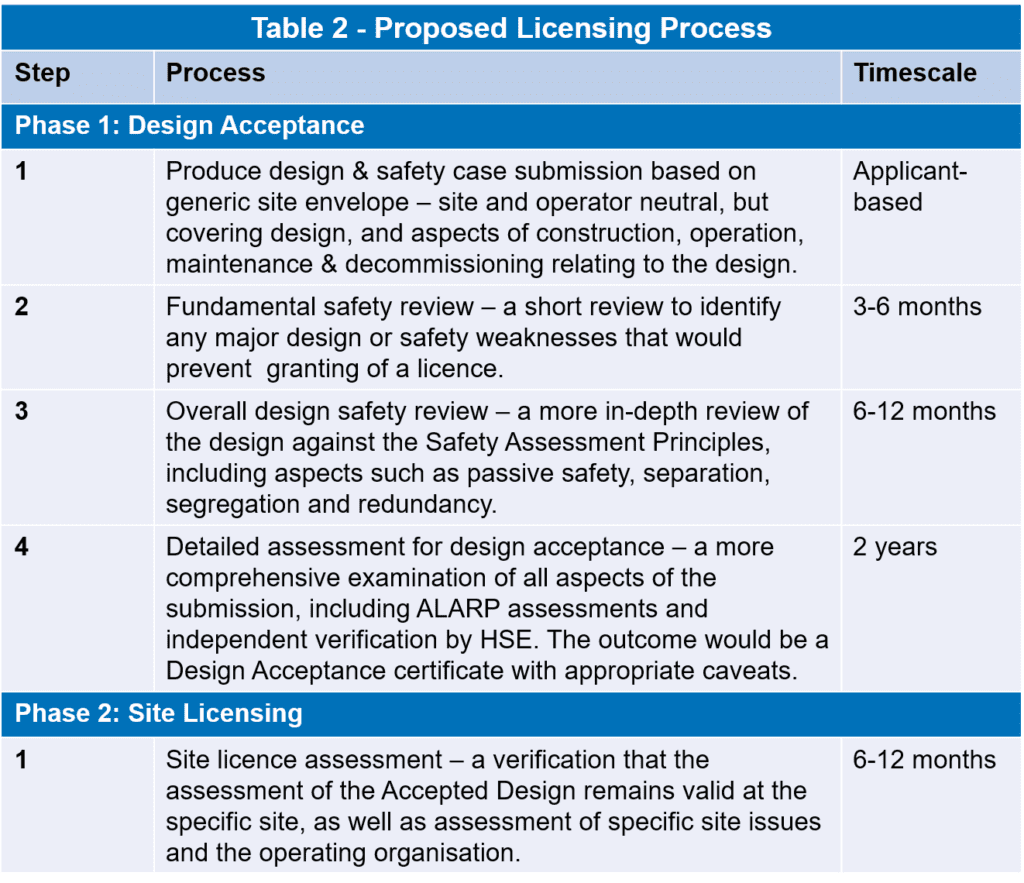

To support this initiative, the UK’s Health & Safety Executive (HSE) undertook a public consultation between March and April 2006, to shape proposals for reforming the regulatory process [Ref 2]. The outcome is a scheme with two phases of licensing. Phase 1 is designspecific, but would include the assessment of generic site hazards, such as earthquake or aircraft impact. It may also take into account approvals from nuclear regulators elsewhere in the world, and would invite review and comment from the general public. Phase 2 would address any site specific issues not covered by Phase 1, and would ultimately result in the granting of a site licence [see Table 2].

CONCLUSION

As the political obstacles facing nuclear power subside, the remaining challenges are no less daunting and are inextricably entwined. The planning and regulatory consent process may influence the choice of reactor design and siting, which influence and are influenced by commercial considerations and the waste management strategy. Although it is still unclear how government and the private sector will work together, the boundaries of this multi-billion pound enterprise are beginning to be drawn.

References

1. DTI, The Energy Challenge, Energy Review Report 2006

2. HSE, The Health & Safety Risks and Regulatory Strategy Related to Energy Developments, June 2006

This article first appeared in RISKworld Issue 10.